tax effective strategies for high income earners

Our tax receipt scanner app will scan. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

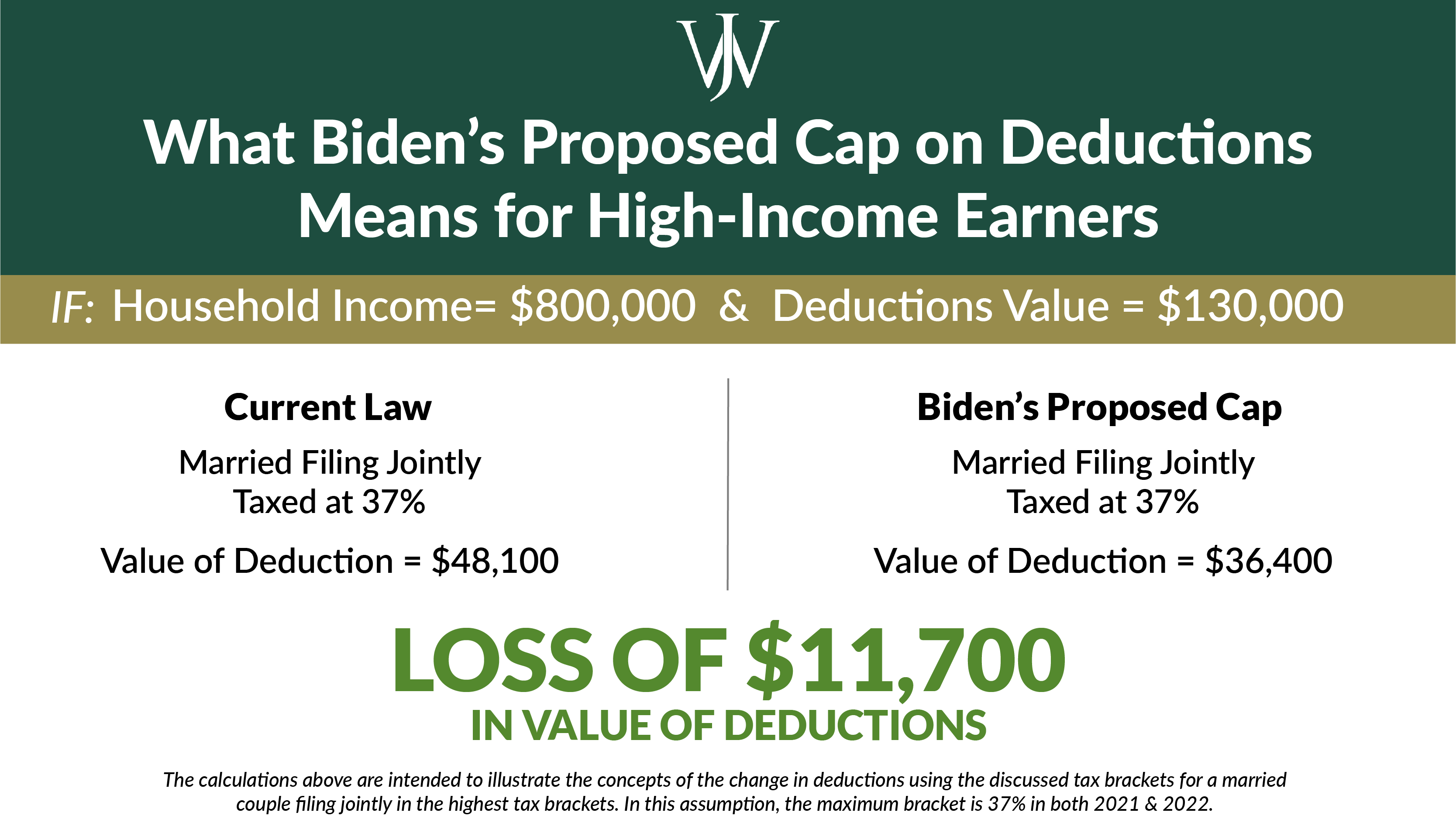

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

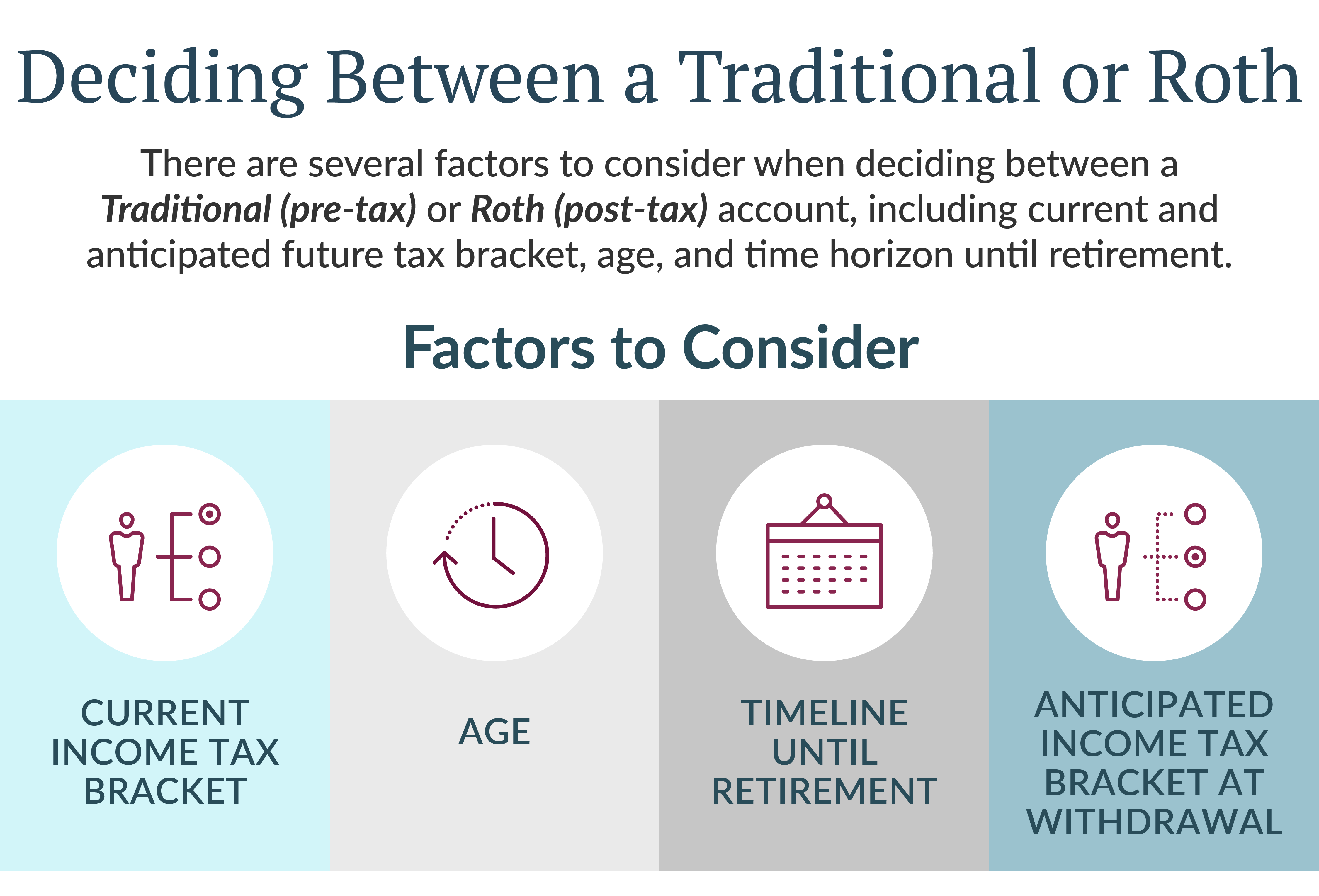

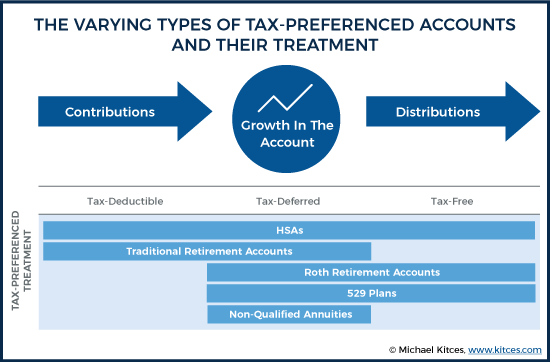

Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income.

. Structure your investments tax efficiently. High-income earners make 170050 per year in. Mon - Fri.

Contrast this to a worker earning 10200 per year. As of 2020 you can contribute up to 3500 per year as an individual or up to 7100 on behalf of your family. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

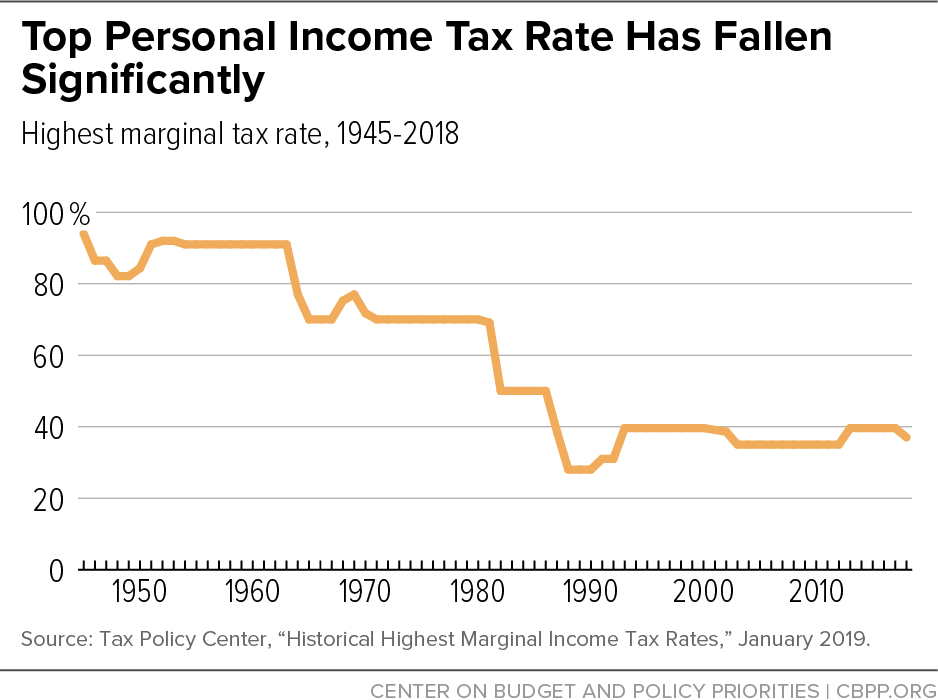

We will begin by looking at the tax laws applicable to high-income earners. The Tax Cuts and Jobs Act TCJA signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025. Tax Planning Strategies for High-income Earners.

50 best ways to reduce taxes for high income earners. For 2022 the maximum employee deferral to 401 k is 20500. If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning you.

As a high-income earner theres a good chance youre worried about tax time. Family Income Splitting and Family Trusts. And things are about to get worse if President Biden gets his way.

Thats especially true if you earn more than 400000 as. If youre over 55 you can. 1441 Broadway 3rd Floor New York NY 10018.

As shown below deductions nearly. Withdrawals are tax-free for medical expenses or any purpose after youre 65. Under RS rules you can deduct charitable cash contributions of up to.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. In this post were breaking down five tax-savings strategies that can help you keep more money in. To do this you would maximize the use of employee benefit plans and health care for your.

That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you. This is a tax-effective strategy because super contributions. Think about the compounding potential when contributions are invested and.

This is one of the. Your income places you in the 35 in the IRS 2022 tax bracket. Use Roth Conversions Wisely and Regularly.

Your earnings compound tax-free. An overview of the tax rules for high-income earners. Knowing that youre in a high tax bracket can be a bit stressful especially if.

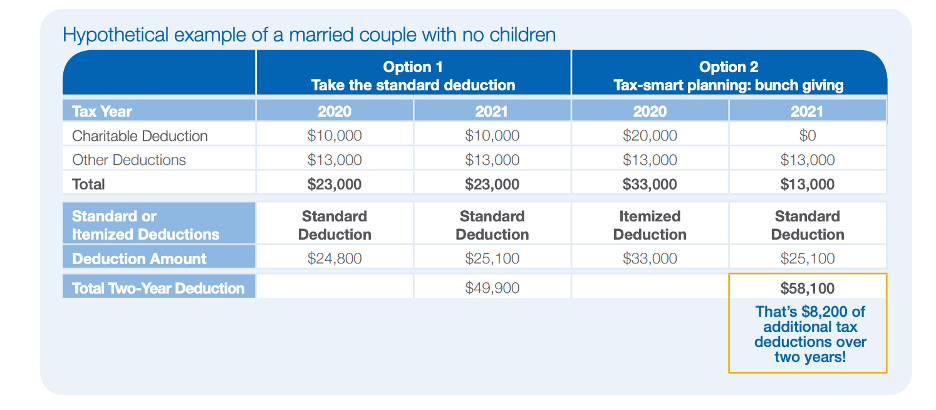

The current top marginal tax rate in the US is 37. Your tax savings will therefore be around 1400. One of the most popular tax-saving strategies for high-income earners involves charitable contributions.

With a CRT high. The more you make the more taxes play a role in financial decision-making. All contributions that you make are tax-deductible.

In fact Bonsai Tax can help. This is one of the most effective tax strategies for high income earners to consider. Income splitting and trusts.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. Max Out Your Retirement Account. This is one of the most important tax strategies for you as a high-income earnerIf properly structured family trusts or partnerships can help you.

Effective Tax Planning Strategies For Higher Income Earners Kalambo Consulting Kalambo Cpa

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Can We Fix The Debt Solely By Taxing The Top 1 Percent Committee For A Responsible Federal Budget

Short Term Rental Tax Strategy For High Income Earners

Tax Reduction Strategies For High Income Earners 2022

9 Ways For High Earners To Reduce Taxable Income 2022

5 Tax Strategies For High Income Earners Pillarwm

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

Tax Planning Strategies For High Income Earners The Private Office

Tax Implications Of Your Financial Planning Strategy Johnson Financial Group

Tax Strategies For High Income Earners Youtube

Your 2022 Savings Strategies For High Income Earners Fuchs Financial

Tax Strategies For High Income Earners Taxry

10 Tax Planning Strategies For High Income Earners Gamburgcpa

The Hierarchy Of Tax Preferenced Savings Vehicles

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management